Ground Rent Investments & Creating Value

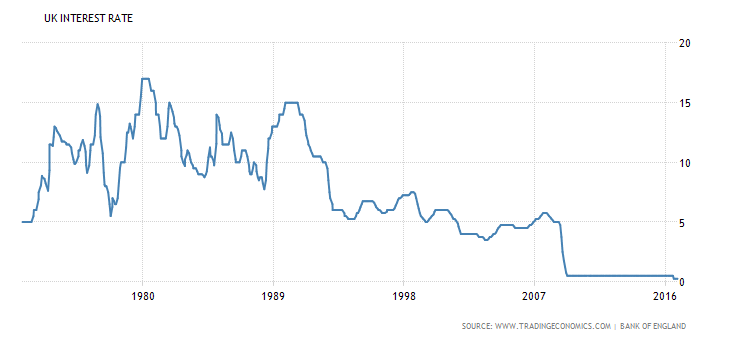

Over the years we’ve all heard about marriage value and it’s always taught in the valuation modules on RICS accredited courses. And its perhaps because of this that there’s a neagtive attitude Ground Rents and Long Leasehold interests. I finished my Postgradute University Course in 2002 and at that time interest rates were at 4.00% and not only that they were also at a 35 year low, so it is perhaps unsurprising that the concept of “divorce value” didn’t really exist as a valuation method. In fact, during the last half century, it is only within the last 8 years that rates have remained below 5%.

UK Interest Rates over the last 50 years

Looking at the graph above, which charts interest rates over the last 50 years, it is quite clear to see the seismic change in interest rates brought about by the recession and the Bank of England’s moves to avert an economic meltdown.

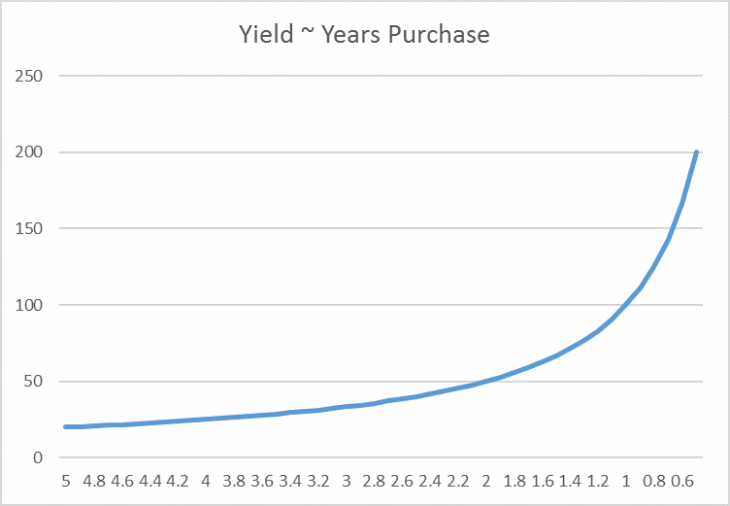

So what has all this got to do with Ground Rent Investments and creating value? With UK interest rates at 0.25%, yields on RPI indexed ground rents, in fact all ground rents for that matter, have fallen significantly. There is of course an exponential correlation between yield movement and YP, which once below 5% really starts to drive up pricing, as demonstrated in the chart below.

Yield ~ Years Purchase – Correlation Chart

Commercial Ground Rents – Creating Value

By splitting an unencumbered Freehold Interest into a Freehold subject to a Long Leasehold interest you create what I like to call divorce value.

By splitting the income stack in to super senior income (Ground Rent) and standard income you are able to apply different multipliers to each. The Ground Rent income, which is effectively AAA can be valued at significantly lower yield than the majority of standard occupational tenants. Apply the separate yields to each element of the income stack and the sum of the parts is worth more than the sum of the whole…..as I said, Divorce Value.

Here are some numbers

Freehold Office Building

ERV – £1,000,000

Gross Yield 7%

Value £14,285,000

Freehold Office Building Split into Freehold & Long Leasehold Interests

Ground Lease Element

Ground Rent – £100,000

Gross Yield – 3.1%

Value £3,225,000

Long Leasehold Element

Net Rent £900,000

Gross Yield 7.5%

Value £12,000,000

Total Value £15,225,000

Value Added £940,000